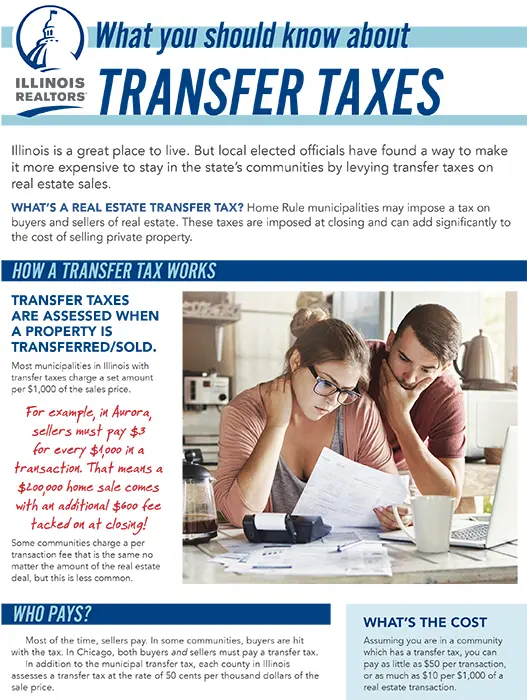

What you should know about Transfer Taxes

Illinois is a great place to live. But local elected officials have found a way to make it more expensive to stay in the state’s communities by levying transfer taxes on real estate sales.

What’s a real estate transfer tax? Home Rule municipalities may impose a tax on buyers and sellers of real estate. These taxes are imposed at closing and can add significantly to the cost of selling private property.

How a Transfer Tax works

Transfer taxes are assessed when a property is transferred/sold.

Most municipalities in Illinois with transfer taxes charge a set amount per $1,000 of the sales price.

For example, in Aurora, sellers must pay $3 for every $1,ooo in a transaction. That means a $2oo,ooo home sale comes with an additional $6oo fee tacked on at closing!

Some communities charge a per transaction fee that is the same no matter the amount of the real estate deal, but this is less common.

Who pays the Transfer Tax?

Most of the time, sellers pay. In some communities, buyers are hit with the tax. In Chicago, both buyers and sellers must pay a transfer tax.

In addition to the municipal transfer tax, each county in Illinois assesses a transfer tax at the rate of 50 cents per thousand dollars of the sale price.

What’s the cost

Assuming you are in a community which has a transfer tax, you can pay as little as $50 per transaction, or as much as $10 per $1,000 of a real estate transaction.

How does a community impose a Transfer Tax?

Since 1997, communities in Illinois must ask voters through a referendum for permission to impose a transfer tax. Even if a community already has a transfer tax, it still must ask voters for approval to adjust the tax rate.

An important note: Only a Home Rule community can impose a transfer tax. In Illinois, that typically means a municipality has more than 25,000 residents or voters in the community have agreed to yield direct say over tax and fee increases to their elected officials.

More than 70 Illinois communities have transfer taxes of varying amounts

Real Property Alliance has an updated list of communities and the tax rates.

The dangers of Transfer Taxes

Transfer taxes are assessed when a property is transferred/sold. Most of the time, sellers pay. In some communities, buyers are hit with the tax.