The number of statewide home sales and the available housing inventory in May 2023 dropped in comparison to May 2022 figures, according to data from Illinois REALTORS®.

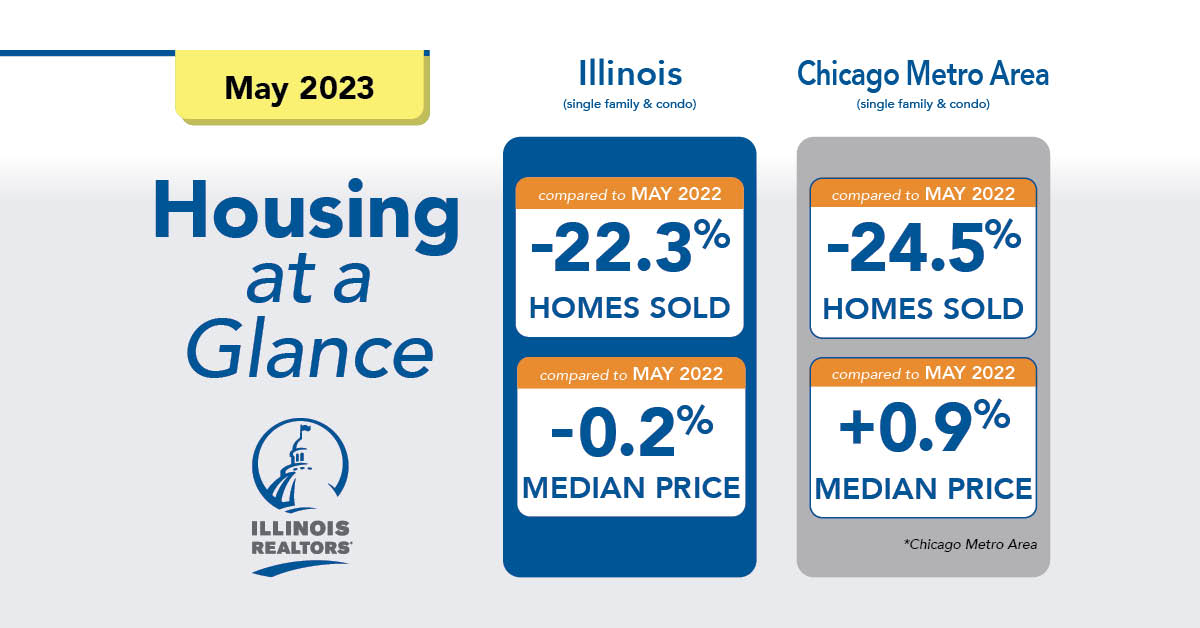

In May 2023, statewide home sales (including single-family homes and condominiums) of 12,817 homes sold was 22.3 percent lower than 16,492 sold in May 2022. Also, the monthly median price of $275,000 in May 2023 was 0.2 percent lower than it was the year before at $275,590.

In May 2023, homes sold an average of 28 days, up from 24 days a year earlier. Available housing inventory in May 2023 totaled 17,649 homes for sale, a 27.3 percent decline from May 2022 when 24,268 homes were on the market. The number of available homes for sale is the second lowest monthly average since 2008, the last year Illinois REALTORS® had such records.

“Due to the low number of houses available for sale throughout the state, it is a seller’s market and still a good time to consider selling your home. But consumers should contact a REALTOR® first, to get expert advice on how to do so,” says Michael Gobber, Illinois REALTORS® 2023 President and designated managing broker-partner, Century 21 Circle in Westchester. “But those interested in buying should still consider doing so as well, they too need to sit down with their REALTOR® to fully discuss their wants and needs in the purchase.”

In the nine-county Chicago Metro Area, May 2023 home sales (single-family and condominiums) totaled 8,952 homes sold, down 24.5 percent from May 2022 sales of 11,850 homes.

The median price of a home in the Chicago Metro Area in May 2023 was $330,000, up 0.9 percent from $326,950 in May 2022.

“The number of home sales is significantly lower than at this time last year,” said Dr. Daniel McMillen, head of the Stuart Handler Department of Real Estate (SHDRE) at the University of Illinois at Chicago College of Business Administration. “Interest rates remain high, and homeowners who bought their properties at a time of low interest rates are reluctant to move to a new home that would need to be financed at a much higher rate. Although we predict home prices to follow the usual seasonal pattern and peak in June, we predict the decline in prices to be lower in July and August than was the case in 2021 or 2022. Our forecasts indicate that the number of sales will remain at about their current levels in July and August.”

The city of Chicago saw a 29.0 percent year-over-year home sales decrease in May 2023 with 2,397 sales, down from 3,374 in May 2022.

The median price of a home in the city of Chicago in May 2023 was $335,000, down 4.4 percent compared to May 2022 when it was $350,500.

“In May, we saw a tempering of the market compared to last month. An increase in closed sales compared to April is a sign of a summer market rife with opportunities,” said Sarah Ware, president of the Chicago Association of REALTORS® and principal and designated managing broker for Ware Realty Group in Chicago. “As always, eyes are on mortgage rates as they creep down.”

Sales and price information are generated by Multiple Listing Service closed sales reported by 22 participating Illinois REALTOR® local boards and associations including Midwest Real Estate Data LLC data as of June 7, 2023, for the period May 1 through May 31, 2023. The Chicago Metro Area, as defined by the U.S. Census Bureau, includes the counties of Cook, DeKalb, DuPage, Grundy, Kane, Kendall, Lake, McHenry and Will.

Based on the Freddie Mac data, the monthly average commitment rate for a 30-year, fixed-rate mortgage was 6.43 percent in May 2023, up from the previous month of 6.34 percent. The May 2022 average was 5.23 percent.

Find Illinois housing stats, data and forecasts at www.illinoisrealtors.org/marketstats.

Illinois REALTORS® is a voluntary trade association whose more than 50,000 members are engaged in all facets of the real estate industry. In addition to serving the professional needs of its members, Illinois REALTORS® works to protect the rights of private property owners in the state by recommending and promoting legislation to safeguard and advance the interest of real property ownership.